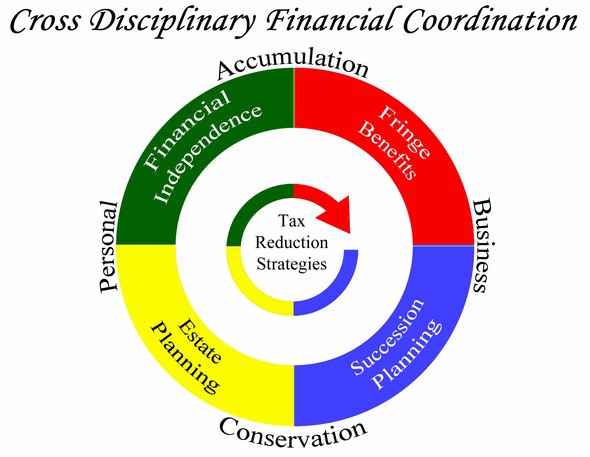

Our Services

The Key Pieces of a Sound Financial Plan

Financial Independence: Can You Retire When You're Ready?

If you are like most business owners, you tend to put all your money back into your business. Relying on your business to be your sole source of retirement income is like putting all your eggs in one basket. Financial Independence includes:

- Investment Planning

- Retirement Planning

- Contingency Planning

Estate Planning: What Will You Leave Behind?

Estate Planning is especially important for business owners since a significant portion of your estate – and your family’s source of income after your death – is tied up in your business. Estate Planning includes:

- Ownership Structure of Assets

- Proper Beneficiary Designations

- Estate / Asset Protection Strategies

Succession Planning: What is Your Exit Strategy?

Is it a coincidence that only 32 percent of business owners have a current succession plan in place and only about 30 percent of businesses actually survive into the next generation? Probably not. Succession planning includes:

- Buy-Sell Agreements

- Business Valuation

- Entity Structure

Fringe Benefits: Who Keeps Things Running Smoothly?

Your “key” employees are one of your most important assets and can be critical to the success of your business. You can offer benefits to your employees designed to motivate, reward, and retain top talent. Fringe Benefits includes:

- Retirement Plans

- Healthcare Benefits

- Key Man Protection

Areas of Focus

Business Owner Strategies

Family owned businesses are central to the U.S. economy, contributing 64% of the U.S. gross domestic product, employing 62% of the workforce and creating 78% of all new jobs.1 Yet only 40% of these businesses survive into the second generation, and only 13% will still be around by the third.1 The reasons are varied, but include family conflict, failure to design a proper succession plan and federal estate taxes. To avoid a similar fate, business owners need a plan. With the support of your accounting and legal advisors, we can help you structure and implement a plan to help towards achieving your objectives in the following areas:

- Business succession planning, which may include dispositions during life and at death

- Executive compensation plans

- Employee group benefits

1”Facts About Family Business,” Center for Family Business, www.business.fullerton.edu, 2012.

Economic Concepts

Taxes. Living Expenses. Inflation. Death. That’s about as much as most people can predict about their future. But what if you could get a realistic perspective on the ability of your income and assets to meet your long-term needs and objectives? What if you could analyze a variety of ‘what-if’ scenarios to prepare for all the contingencies the future might hold?

You can potentially stack the deck in your favor. And you don’t need a crystal ball to do it. You just need a sophisticated, innovative financial planning model that gives you the power to chart your own future financial course. Without it, your financial plans for the future are not actually plans- but nothing more than guesswork. Our proprietary Financial Condition Model will:

- Assess the long-term impact of taxes, inflation, and each of the financial strategies you’re now using or planning to use.

- Project your annual cash flow (income and expenses) alongside your growth over the full length of your life expectancy.

- Estimate the size of your net worth each year, as well as your savings, your investments and your transferable estate.

It might even revolutionize your thinking. Our modeling can help you project and control your financial future. It can help you decide whether the course you’re following today is prudent or even adequate. How does the strategy you just implemented or are now considering compare with other available options? What might happen if circumstances change (such as higher taxes, higher inflation or lower returns on your investments)?

The answer might change your mind about the way you’ve prepared for the future. If so, we’ve got the expertise and the tools to help. We take the time to understand your needs as well as your goals and then prepare your financial profile. Only then will we present a range of solutions for you to consider.

Get a head start on a better plan for your future.

Retirement Planning

The 2012 Retirement Confidence Survey found that only 14% of workers are very confident they will have enough money in retirement, and 70% of worker plan to work for pay after they retire.1 Further, 66% of worker and their spouses reported they have saved for retirement – a decline from 75% reported in 2009. To help guide you toward retirement income security, we offer:

- Needs assessment

- Retirement income modeling

- Benefits analysis

- Distribution options

1”2012 Retirement Confidence Survey,” Employee Benefit Research Institute and Mathew Greenwald & Associates.

Charitable Giving

Winston Churchill once said, “We make a living by what we get, but we make a life by what we give.” This is true no matter how grand or modest a contribution you can afford. And the fact is, your gift or bequest can have a significant and beneficial impact on the lives of others – if you know how to give most effectively.

A charitable gift of a life insurance death benefit can multiply the impact of your donation many times over. It allows you to leverage your gift and ensure that your own personal contribution impacts your charity directly in a way greater than you thought possible. Even if you have a limited discretionary cash flow, you can make a meaningful gift using a life insurance policy while your charity could receive significant sums of money.

Investment Planning

Our approach to investment planning relies on core principles developed and tested since the inception of our firm. The principles are:

- Asset allocation provides the foundation to managing portfolio risk and return potential;

- Tax efficiency and asset location are critical;

- Portfolio expenses must be scrutinized;

- No single money management firm can be all things to all people; and

- Our most important role is to be an objective advocate. Our goal is to control costs, be tax efficient and manage risk. This provides an effective way of helping towards achieving your financial goals.

We leverage the power of technology to drive our disciplined five-step investment process:

- Step 1 – Advice and planning

- Step 2 – Portfolio modeling, analysis and design

- Step 3 – Investment policy statement development planning

Implementation takes the IPS one step further by clearly defining the specific investments to be included in the portfolio and proposing how, when and where they should be incorporated. Our investment management platform offers:

- Step 4 – Implementation, manager search and selection

- Step 5 – Ongoing monitoring, due diligence and reporting*

- (*Offered through Lincoln Financial Advisors Corp. asset management programs)

Estate / Asset Protection Strategies

Generally, the goals of estate planning are to provide for financial security in life and to maximize – given the client’s goals and objectives – the estate for family and other heirs following death. To fully leverage estate preservation opportunities and develop strategies to help achieve distribution objectives, we consider:

- Will and trust design strategies

- Property ownership alternatives, including the review of titling and beneficiaries to coordinate with your overall estate plan

- Estate tax reduction techniques

- Insurance analysis

- Qualified plan distribution alternatives

- Family-gifting strategies

- Charitable planning

- Employee stock option optimization

Employee Benefits

As your business grows and you add staff, choosing benefits and retirement plans becomes more complicated. You have many options to choose from. The variety, however, gives you a better chance of picking a plan that can more precisely helps meet your needs – such as rewarding key employees, beefing up their savings, and providing incentives for them to stay with your company.

At the same time, as competition and other forces strain company profits, business owners are looking for ways to gain more value from their executive benefit dollars. Once you have narrowed down that number, you should meet with them privately to discuss their individual needs. Their goals may range from wanting long-term financial security to sheltering their retirement next-eggs from excessive taxation.

Understanding what is important to them will help you assess the type of benefits plan that will interest them most. At the same time, these employee discussions are a good opportunity for you to express your desire to keep these workers satisfied, what they can expect in terms of a retirement package, and what is expected of them in return.

Insurance

Say the words “life insurance” to some people, and you’re likely to get a less than enthusiastic response. But, more and more frequently, people are discovering that life insurance can be a helpful financial planning tool. Life insurance offers a way for you to help provide for your family, protect your business, and make charitable gifts without reducing your estate.

A life insurance policy on your life can help provide your future heirs with funds to pay the expenses of settling your estate without dipping into its assets. It also can help replace the income that your family may lose as a result of your death. A life insurance policy is one way to ensure that money will be available to your future heirs for their immediate or long-term financial needs.

If you’re the owner of a small business, life insurance proceeds can help supply the funds to pay estate taxes and administration expenses eliminating the possibility that the business will have to be sold to meet these needs. You also can use life insurance to fund a buy-sell agreement for the purchase of your business interests by other stockholders, partners, or your corporation.

You can exclude insurance proceeds from your estate by having a trust or the individuals who will benefit from the proceeds purchase and own the policy. A trust may offer several advantages, so you’ll want to consider all your options.

Employers often take advantage of life insurance to provide deferred compensation, typically to key employees. The employee is promised benefits at retirement or a lump-sum death benefit, should the employee die before retirement. Employer-owned life insurance on the employee’s life provides the employer with the cash to help meet its obligation to the employee.